College Majors and Employment Rates

From the Washington Post:

(click to embiggen)

A few things I see regarding this:

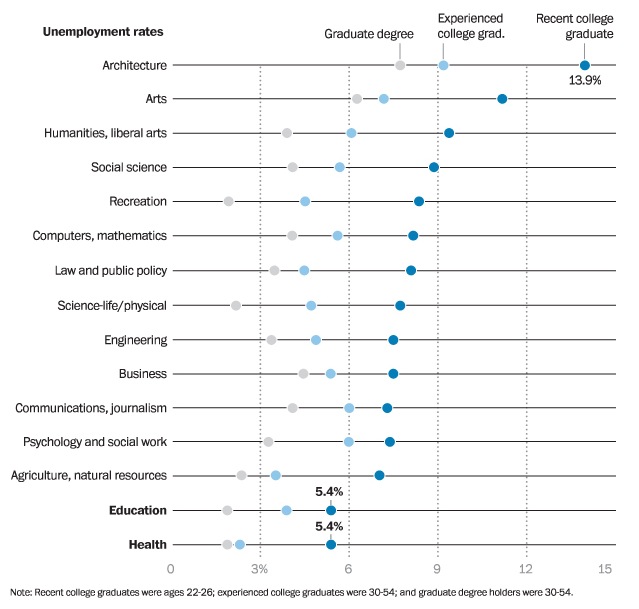

1) From a market perspective, it looks as though the smallest return (measured as “likelihood of employment”) on investment in an advanced degree is in the arts, law, business, ag, and health. I do realize that measuring return as “lifetime investment” instead of as “higher likelihood of employment” on an investment in an advanced degree would result in a much different list.

2) Note the bottom of the chart: “experienced college grads” and “graduate degree holders” are both defined as between 30-54 years of age. Someone 54 years old hasn’t been in college for a very long time and in fact probably has multiple children that are college graduates themselves. That skews the perspective of this chart somewhat, considering that the unemployment rate of 20-somethings is significantly higher than the unemployment rate for those in their 40s and 50s.

3) Note the fields with the lowest unemployment (sub-3%) among those with graduate degrees and experience. Health. Education. Ag/Natural Resources. Science. Recreation. All those fields seem to be pretty secure areas. If you can get a job there in the first place (not hard in health and education), you’ve probably got one for life. In health care, you apparently don’t even need an advanced degree.

So, unsurprisingly, the field your kids or grandkids major in matters quite a lot when it comes to job opportunities. It’s one thing to follow your passions. It might be quite another thing to be able to support yourself and a family while doing so.